Imagine catching a fraudulent transaction the moment it happens before your SMB loses money or customer trust. That capability, once limited to large banks, is now within reach for small and mid-sized businesses in the UK. With real-time fraud detection tools powered by AI, SMBs can not only limit financial losses but also protect reputation and scale securely.

Why Fraud Is a Growing Threat for UK SMBs

UK businesses are under increasing pressure from fraudsters:

- In 2023, the value of recorded fraud in the UK more than doubled to £2.3 billion. The BDO Fraud Track report says high-value fraud cases (over £50 million) increased by 60% year-on-year.

- According to a Bank of England survey, 33% of financial-services firms report using AI for fraud detection currently. Another ~31% plan to adopt it soon.

- SMEs face direct threats: UK Finance reports that unsolicited fraud attempts (emails/texts) are common, with some SMEs losing large sums due to APP (Authorised Push Payment) fraud.

These stats show that fraud isn’t a distant risk, it’s an immediate concern for SMBs. Real-time detection isn’t optional anymore; it’s becoming essential.

What Is Real-Time Fraud Detection with AI?

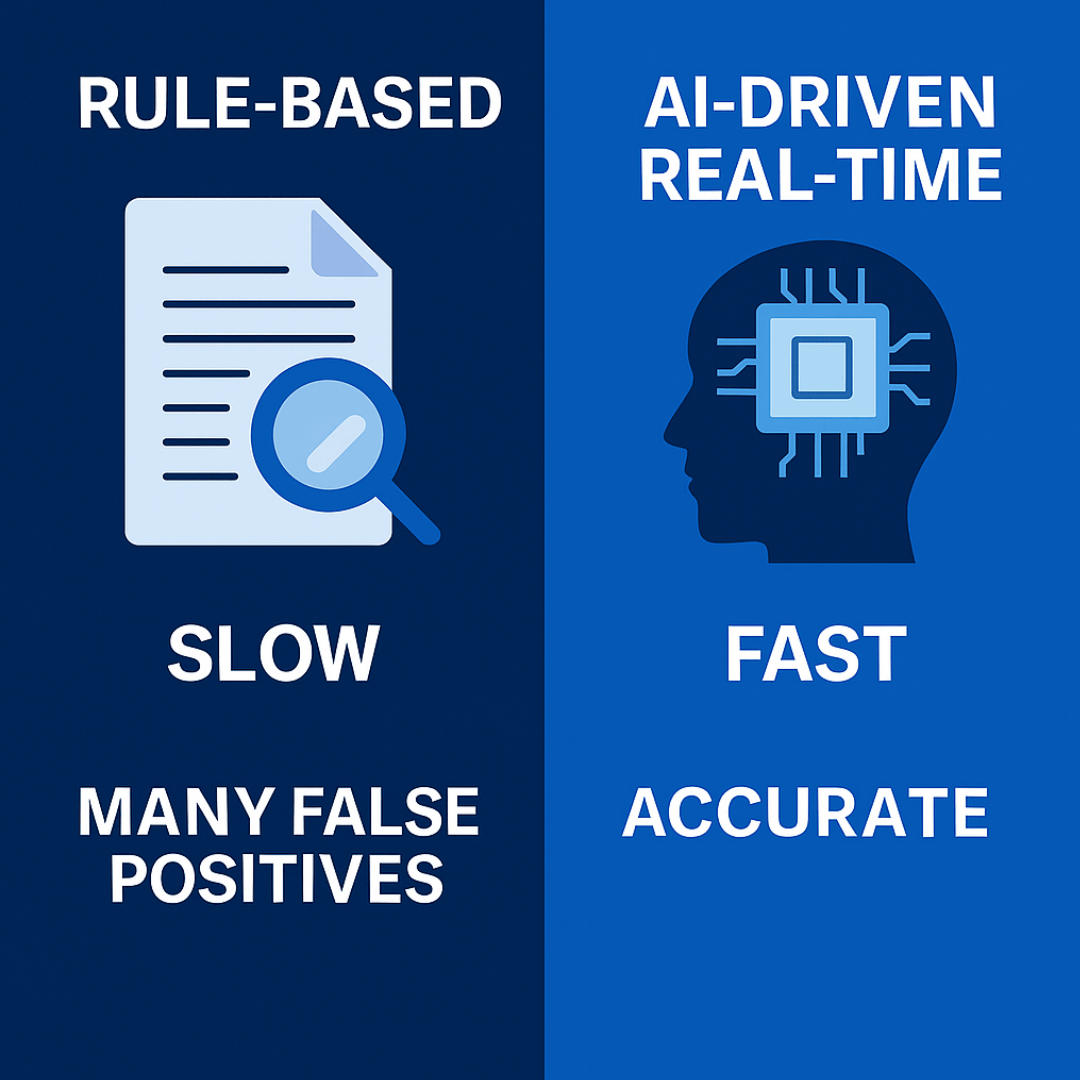

Real-time fraud detection means monitoring transactions, behaviours, or access in milliseconds, flagging suspicious activity immediately rather than after the fact. AI/ML models help by analysing large datasets to find anomalous patterns based on device, location, historical transaction behaviour, or even payment method.

Key components include:

- Pattern recognition: learning normal behaviour and spotting deviations.

- Anomaly detection: triggering alerts for unusual patterns.

- Risk scoring: assigning a risk level to transactions or user actions.

- Automation & alerting: sending immediate holds, alerts, or blocking actions.

According to a PwC report, many UK financial institutions already use machine learning-based models to detect suspicious activity, reducing false positives and improving detection efficiency.

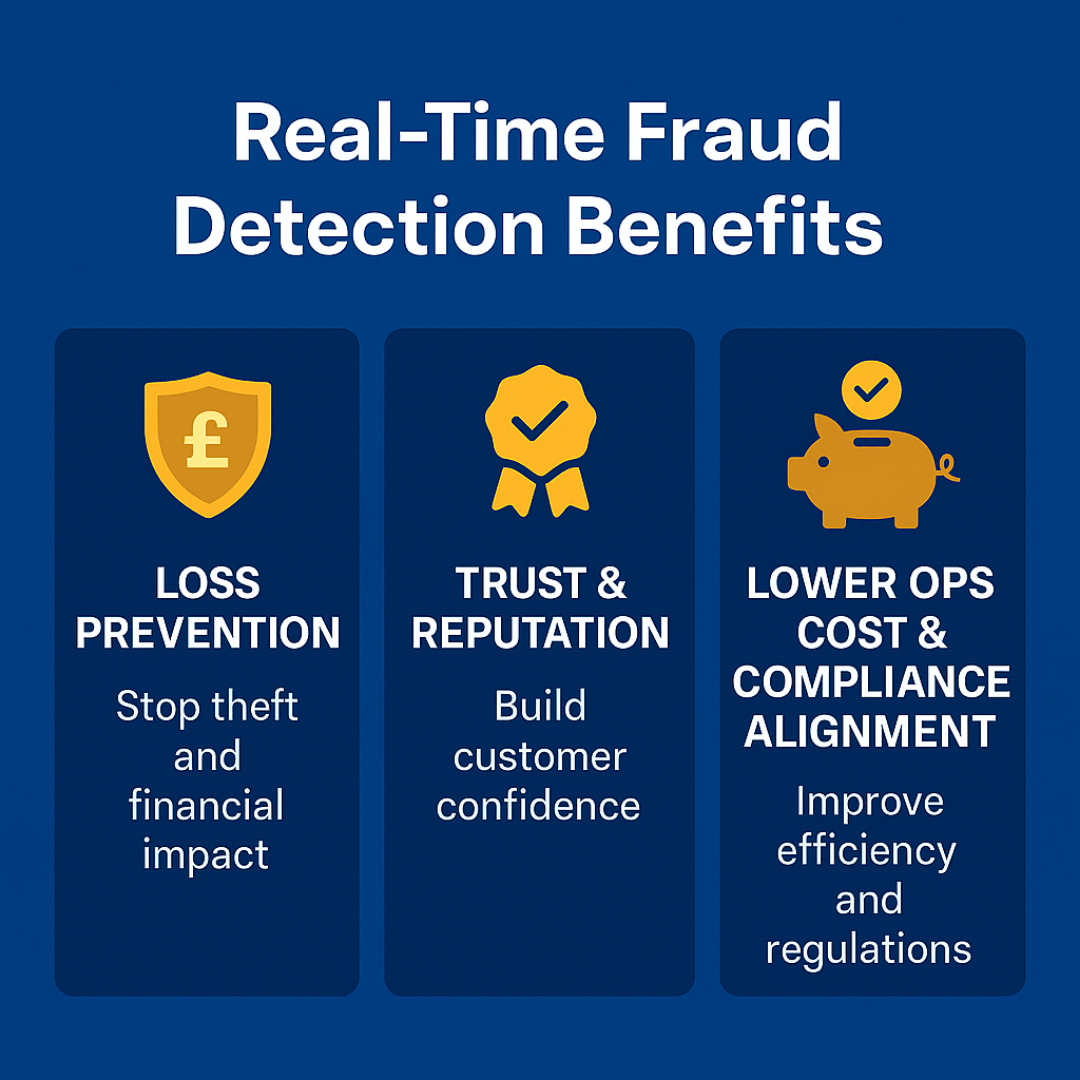

Benefits of Real-Time AI Fraud Detection for SMBs

AI-powered real-time fraud detection brings several advantages, especially for small businesses:

1. Prevent Losses Immediately

Rather than investigating fraud after the damage’s done, you stop it at the point of occurrence, avoiding not only direct loss, but also indirect costs like chargebacks, customer churn, and legal fees.

2. Improve Customer Trust & Reduce Abandonment

Customers expect safe transactions. When fraud or suspicious requests are caught early, SMBs can maintain trust, important when Tink & Cebr research shows UK consumers abandon transactions when they don’t trust payment methods.

3. Lower Operational Costs

Automated detection reduces time staff spend manually investigating suspicious transactions. False positives are trimmed, which means fewer “innocent” transactions blocked and fewer hours wasted.

4. Compliance & Risk Management

Regulations in the UK and EU increasingly expect businesses to have active fraud detection, especially for online payments. Real-time detection helps SMBs stay ahead of regulatory requirements and audits.

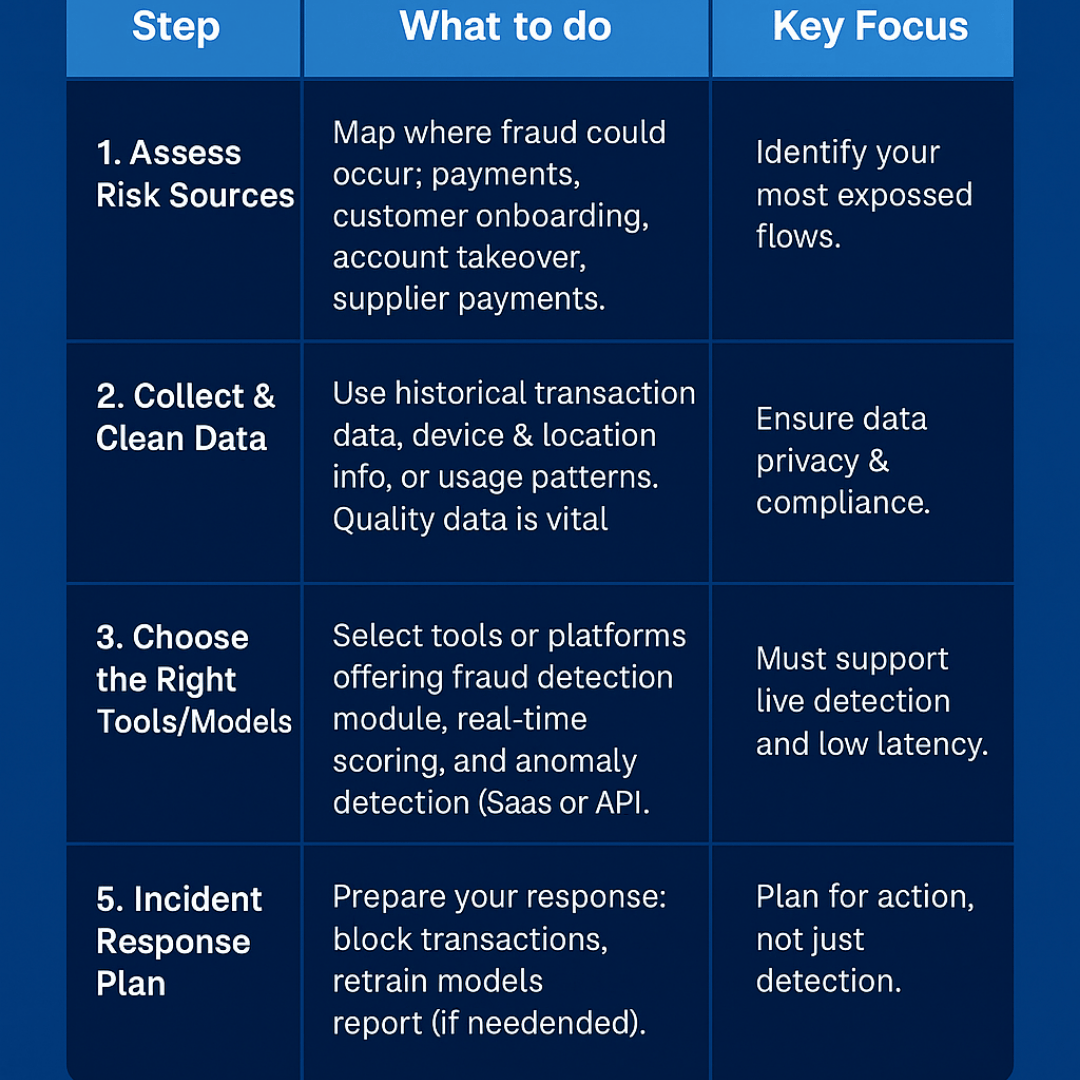

How SMBs Can Deploy Real-Time Fraud Detection AI

Here’s a practical 5-step plan for SMBs to get started:

Use Cases Where Real-Time AI Fraud Detection Shines

- eCommerce & Retail: Detecting fraud in online orders, fake card use, unusual shipping addresses, or high order volume from one IP.

- Subscription Services: Catching account takeovers or abusive trial‐to‐paid upgrades in real time.

- Payment Gateways & FinTech: flag suspicious payment flows or transactions that deviate from user behaviour.

Also, in the Bank of England’s report, firms using AI for security and fraud say that it improves speed of detection and accuracy over traditional rules-based systems.

Common Challenges & How To Overcome Them

- False Positives: Too many alerts can block legitimate customers. Mitigate with continuous tuning, combining ML with business rules.

- Data Privacy & Regulation: Using personal or transactional data triggers privacy standards (GDPR, UK law). Always anonymise where possible and follow legal & policy guidance.

- Cost & Complexity: Some tools are expensive or require technical expertise. Start with modular AI tools or platforms that integrate with your existing systems.

- Vendor Trust & Explainability: Know how the tool makes decisions (avoid black-box models). Oversight and transparency build trust.

Where to Start, If You’re an SMB

1. Pilot a solution on a small but high-risk flow (e.g. onboarding or certain payment methods).

2. Monitor results closely; track false positives, speed of detection, customer feedback.

3. Scale gradually, expand detection to more types of transactions or user-segments.

4. Combine with broader security measures: MFA, device posture, secure access, etc.

Final Thoughts & Recommended Reading

Real-time fraud detection via AI is no longer just for big corporations. For UK SMBs, it represents one of the most cost-effective ways to reduce loss, maintain customer trust, and stay ahead of regulatory demands. With the right data, tools, and strategy, even small teams can deliver enterprise-level fraud protection.

At I-NET Software Solutions, we help SMBs deploy real-time fraud detection systems that are tuned, compliant, and effective. Book a consultation to see how we can get your business protected now.

For a broader view of UK regulatory expectations and how fraud detection fits into compliance and overall cybersecurity strategy, see our related blog: Cybersecurity Compliance 101: A Guide for SMBs in the UK and EU.