Data governance is often viewed as an enterprise-only discipline, heavy with committees, policies, and compliance documentation. For small and medium-sized businesses, that perception creates hesitation. Yet as organisations rely more on analytics, automation, and AI, clarity around data ownership, definitions, and accountability becomes essential.

A data governance framework for SMBs does not need to be bureaucratic. It needs to be practical, proportionate, and aligned with real decision-making.

Why Data Governance for Small Businesses Is Becoming Critical

Digital transformation is not limited to large enterprises. CRM platforms, marketing automation, cloud accounting, SaaS tools, and AI-powered analytics are now standard components of SMB operations.

Each of these systems generates data. But few businesses define:

- Who owns the data

- What specific terms mean across systems

- How access is controlled

- How data quality is maintained

- How accountability is enforced

The OECD highlights that effective data governance underpins trustworthy AI and digital transformation initiatives.

What Data Governance Actually Means in Practice

Before designing a framework, it is important to clarify what data governance is and what it is not.

Data governance is:

- The assignment of clear ownership for datasets

- The standardisation of definitions across systems

- The control of access and permissions

- The documentation of processes for data handling

- The enforcement of accountability for data quality

Data governance is not:

- A software product

- A one-time documentation exercise

- A compliance-only function

- A purely IT responsibility

ISO 8000 standards reinforce that data quality is contextual and must be fit for its intended use.

The Real Risks of Operating Without Governance

Many SMBs function for years without formal governance. The risks often emerge gradually rather than dramatically.

1. Conflicting Reports

If finance recognises revenue differently from sales, dashboards contradict each other. Leadership confidence declines. Without shared definitions, reporting becomes negotiation rather than analysis.

2. Compliance Exposure

Under UK GDPR, organisations must demonstrate appropriate data handling, security, and accountability measures. A lack of governance increases regulatory vulnerability.

3. AI and Automation Failure

AI systems amplify the quality of input data. If underlying datasets are inconsistent or incomplete, AI outputs become unreliable.

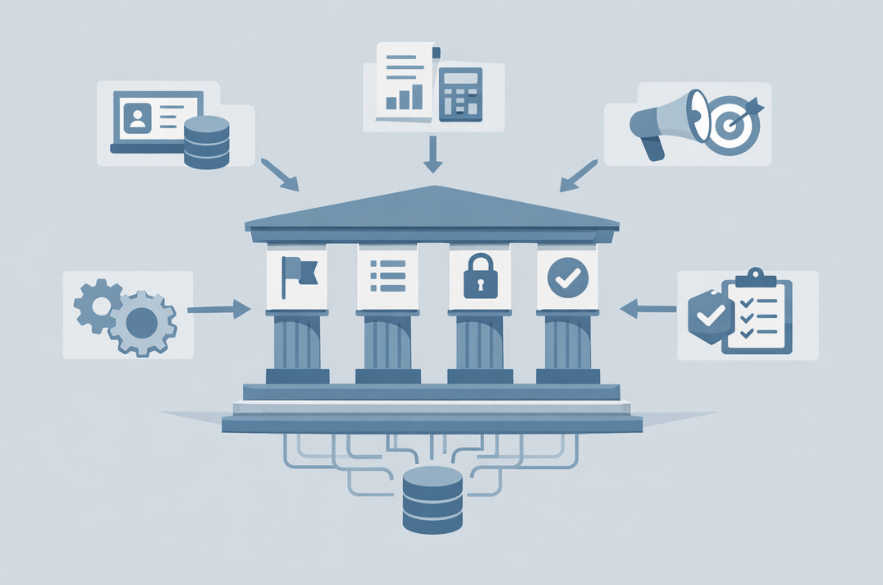

Designing a Lightweight Data Governance Framework for SMBs

Enterprise governance models often fail in smaller organisations because they attempt to replicate large-scale oversight structures.

A practical framework for SMBs should focus on four structured components.

1. Data Ownership and Accountability

Every critical dataset must have:

- A named business owner

- A defined purpose

- Responsibility for quality and updates

Ownership does not require a full-time data steward. It requires clarity.

For example:

- CRM data → Head of Sales

- Financial data → Finance Lead

- Marketing campaign data → Marketing Manager

Ownership ensures accountability when discrepancies arise.

2. Standardised Definitions and Data Glossary

A simple shared glossary prevents internal misalignment.

Define clearly:

- Customer

- Lead

- Active account

- Revenue

- Margin

- Churn

Without standardisation, different systems calculate the same metric differently.

Governance aligns terminology across tools and teams.

Without standardisation, different systems calculate the same metric differently.

Governance aligns terminology across tools and teams.

3. Access Control and Data Security

Governance must align with security best practices.

Access should follow least-privilege principles:

- Administrative rights separated

- Sensitive data restricted

- Regular access reviews conducted

The ICO emphasises structured access control as part of compliance obligations.

4. Documented but Proportionate Processes

Documentation should be:

- Clear

- Short

- Operational

It should define:

- How new data sources are introduced

- How definitions are updated

- How errors are corrected

- How incidents are escalated

The goal is clarity, not bureaucracy.

How to Implement Data Governance Without Disrupting Operations

Step 1: Identify Decision-Critical Data

Start with the data that informs high-impact decisions:

- Revenue forecasting

- Customer acquisition

- Pricing strategy

- Operational planning

Governance begins where financial or operational risk is highest.

Step 2: Align CRM and Finance Systems

Many inconsistencies originate between CRM and accounting platforms.

Align:

- Customer IDs

- Revenue definitions

- Reporting timeframes

Gartner identifies integration between systems as foundational for scalable analytics.

Step 3: Introduce Ownership Meetings (Lightweight)

Short, periodic reviews of:

- Data discrepancies

- Definition updates

- Access permissions

These meetings reinforce accountability without creating bureaucracy.

Step 4: Establish Data Quality Indicators

Track simple indicators such as:

- Duplicate records

- Missing critical fields

- Error rates

- Update frequency

Governance must be measurable.

Data Governance Readiness Review

At I-Net Software Solutions, we help UK organisations design practical, proportionate data governance frameworks that support analytics, AI adoption, and regulatory compliance, without enterprise bureaucracy.

Our Data Governance Readiness Review helps you:

- Identify governance gaps

- Clarify ownership structures

- Standardise definitions

- Improve data integrity

- Prepare confidently for AI initiatives

If your organisation relies on data to make strategic decisions, governance should be intentional, not accidental.

FAQs

Recommended Read

- A Practical Data Governance Framework for SMBs

- Why Passing Cybersecurity Compliance Doesn’t Mean You’re Secure

- Why Consistency Beats Creativity in Scalable UX

- Turning Everyday Business Data Into AI-Ready Assets

- What Cyber Insurance Actually Expects You to Have in Place

- Why UX Fails Long Before Design Does